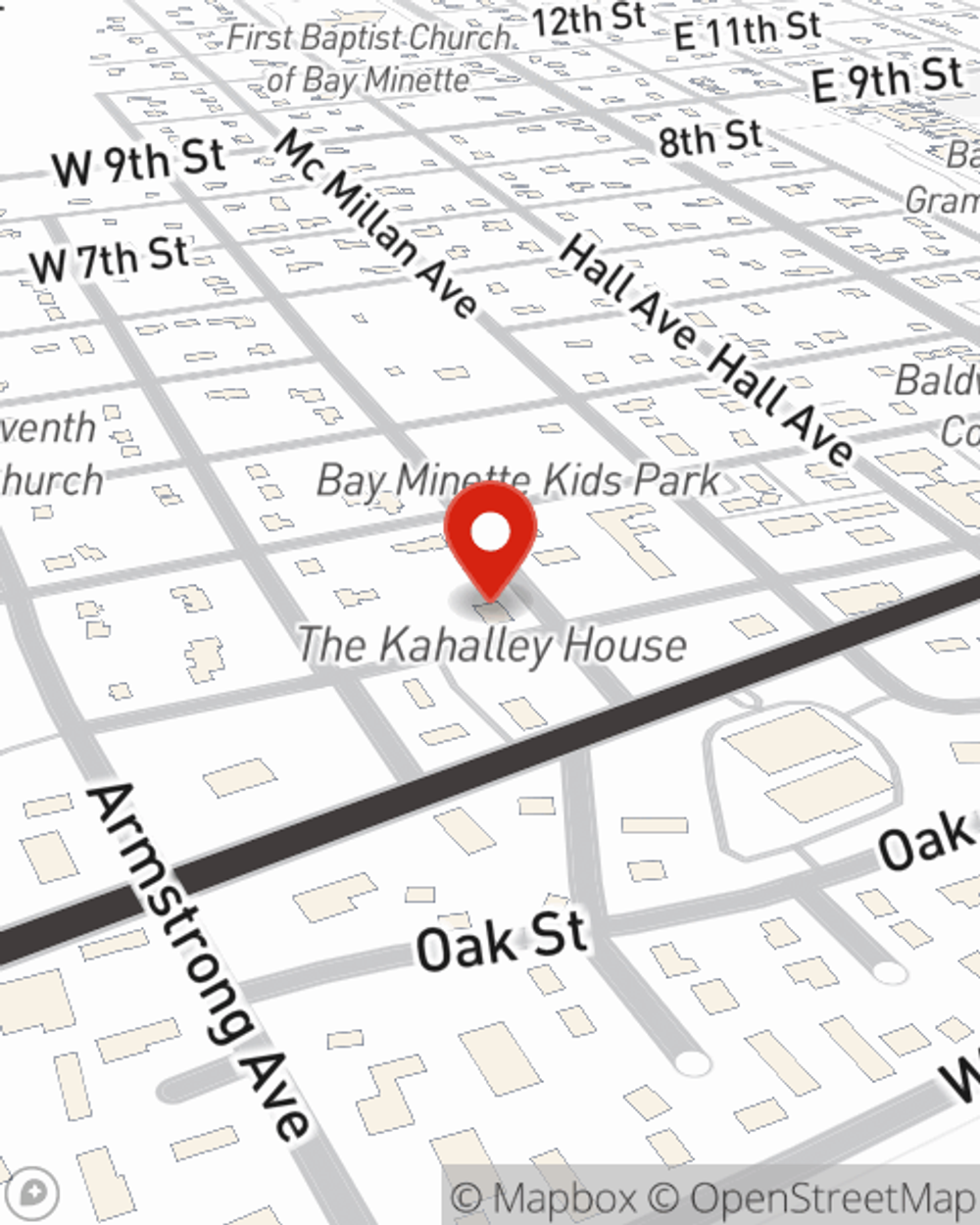

Business Insurance in and around Bay Minette

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Business Insurance At A Great Price!

Being a business owner is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for your family. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, extra liability coverage and a surety or fidelity bond.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Get Down To Business With State Farm

Your company is one of a kind. It's where you make your living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a shop or a facility. Your business is a reflection of all your hopes and dreams. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is to get outstanding small business insurance from State Farm. Small business insurance covers a variety of occupations like a photographer. State Farm agent John Chason is ready to help review coverages that fit your business needs. Whether you are a plumber, a barber or a sporting goods store, or your business is a craft store, a hobby shop or an appliance store. Whatever your do, your State Farm agent can help because our agents are business owners too! John Chason understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Agent John Chason is here to consider your business insurance options with you. Visit with John Chason today!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

John Chason

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.